INTRODUCTION

California’s stock in trade is innovation. From ideas to capital to talent, the critical mass exists in California’s complex business networks to deliver almost any concept to its fullest potential.

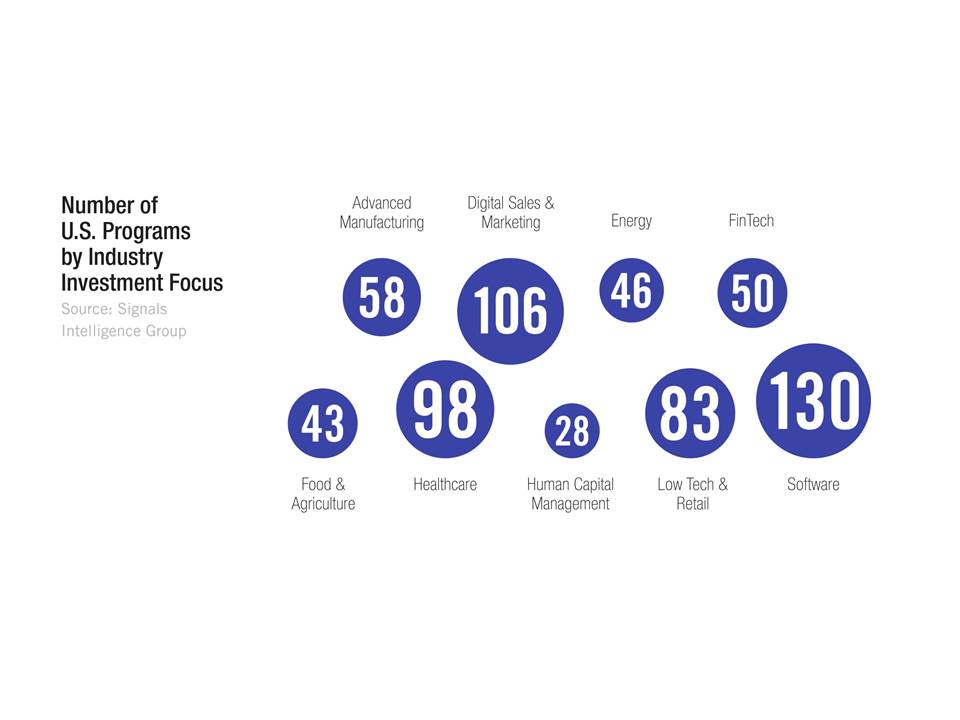

Figure 1a, page 21, from the study California Tool Works.

Accelerators and incubators play a vital role in the state’s innovation ecosystem. Startups often find incubators and accelerators attractive as they go through the pains and pitfalls of early success and failure. As the model has proliferated, accelerators have become the epitome of an industrialized process: startups churned out in volume through an assembly line.

Little effort has been made to track and analyze the performance of incubators and accelerators, their impact on the economy, and whether they deliver value to the startups they serve. This is the first effort to assess the combined impact of California’s incubators and accelerators and begin a process that moves beyond traditional measures of economic impact in an effort to standardize meaningful metrics to track both the contribution of incubators and accelerator to the state’s economy and measure their success.

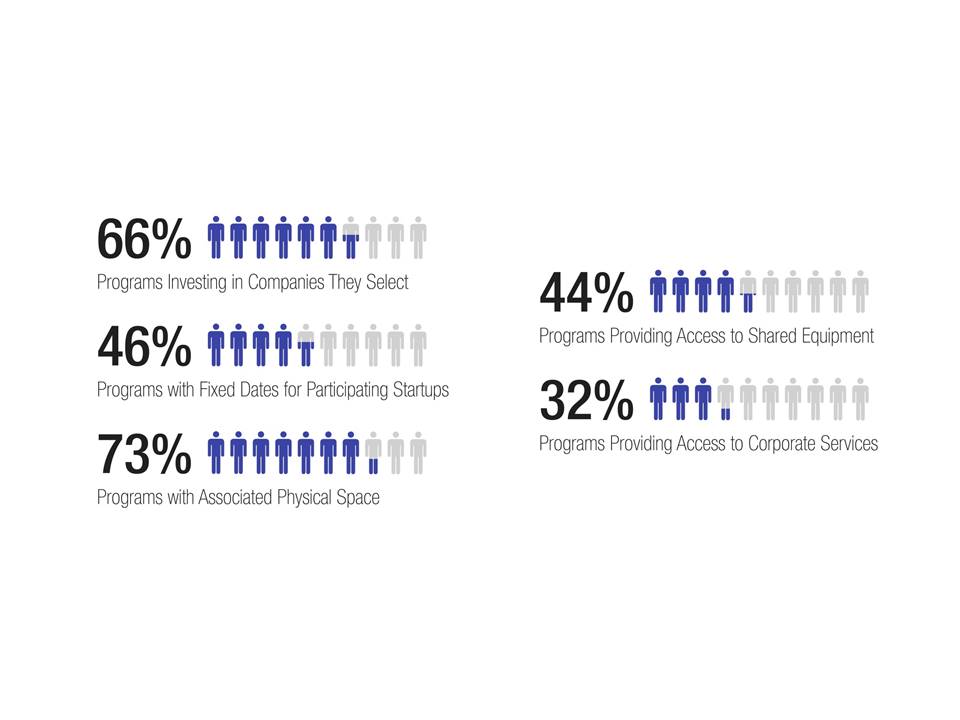

Figure 5, page 26, from the study California Tool Works.

In the short time since the global financial crisis, the number of incubators and accelerators operating in California has risen sharply. Driven by an influx of capital, these new incubator and accelerator programs have become an important part of the innovation ecosystem supporting entrepreneurs. California’s entrepreneurial culture and venture capital resources generate thousands of new startups each year.

Though the terms incubator and accelerator can mean different things to different people, this study uses the terms with specific meaning in mind. An incubator is typically a facility sub-divided into many small spaces, in which the provision of services to resident startups is generally dependent upon real estate and access to shared equipment. An accelerator is typically a program defined by a curriculum of several months of entrepreneurial training provided directly by the accelerator and augmented by networks of mentors.

Figure 22, page 38, from the study California Tool Works.

Despite these generally accepted criteria, there are many shapes and varieties of both incubators and accelerators, including incubators with acceleration programming and accelerators with real estate and access to shared capital equipment more commonly associated with incubators. In short, the proliferation of programs has blurred the traditional lines between these two types of support for entrepreneurs.

Accelerators have become a key ingredient to supporting new generations of startups, whether they are corporate, nonprofit, academic, or private. Many global leaders have established new incubation or acceleration platforms in California in the last few years well beyond the traditional technology and biotechnology focus of the past. This includes automotive companies, big box retailers, and large financial services organizations among others. All of this has happened while the classic incubator structure associated with a university or nonprofit has evolved into new models providing both virtual and physical support facilities for startups.

Figure from Executive Summary, detailed on page 33 of the study California Tool Works.

The total risk capital attracted by portfolio companies of California’s incubators and accelerators represents a massive economic engine for California, the United States, and indeed, the world. The capital raised by alumni of these programs has not been confined to spending within California or the

U.S. economy. Those graduates have harnessed those resources for expansion in the U.S. and the world, and have invested in new jobs, facilities, and equipment, while their spending extends to every corner of the world.

Attracting venture investment is only one purpose served by these programs. Incubators and accelerators also provide critical education and services to help entrepreneurs successfully design and launch new products and build growing companies.

As the growing number of accelerators turns out waves of startups, stakeholders will continue to interrogate and improve this business model in iterations. Investors and entrepreneurs alike have already come to wonder whether 6 percent of equity for four months of networking and pitch development is efficient or expensive, sustainable or untenable.

In addition to assessing systems-level trends, this report provides benchmarking and analysis of incubators and accelerators for the types of facilities and services they provide to entrepreneurs, their definition and measurement of success, and their contributions to the innovation landscape. The report synthesizes economic research, surveys, interviews, focus groups, and summits.

To continue reading and request a copy of the report, please CLICK HERE.

Project partners:

This project was made possible by support from: